How an experienced Medicare advisor can help you save on healthcare expenses

Wiki Article

Understand All the Benefits of Dealing With a Medicare Advisor for Your Strategy Choice

Maneuvering through the complexities of Medicare can be testing for numerous people. Collaborating with a Medicare advisor supplies essential insights into available options. These professionals offer customized referrals based upon special requirements and monetary scenarios. They additionally make clear essential enrollment due dates and possible charges. Recognizing the subtleties of Medicare insurance coverage is necessary. The benefits of such advice can significantly influence one's healthcare trip. Discovering these advantages can expose useful techniques for reliable strategy option.Experience in Medicare Options

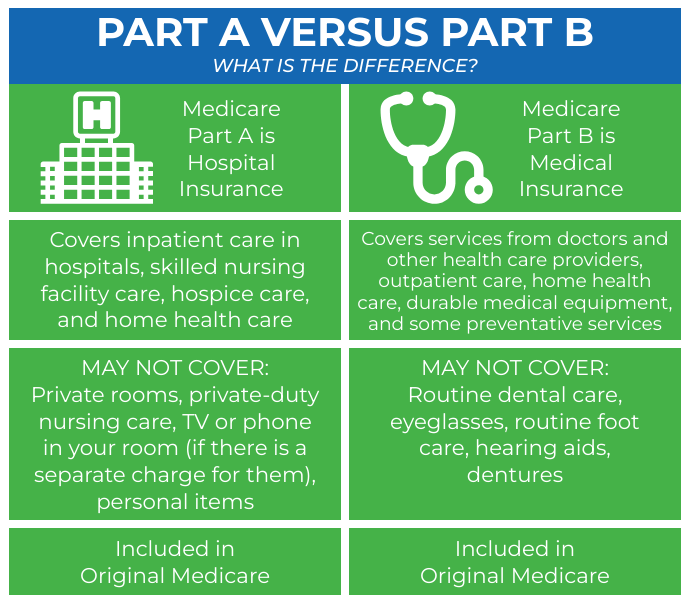

When maneuvering with the intricacies of Medicare, people often profit from seeking advice from a specialist that has a deep understanding of the different choices readily available. These advisors are well-versed in the ins and outs of Medicare Components A, B, C, and D, enabling them to clarify the distinctions and effects of each - Medicare agent near me. Their know-how includes comprehending qualification requirements, registration durations, and the nuances of extra plansBy leveraging their knowledge, they can assist individuals navigate prospective risks, guaranteeing that recipients select the most appropriate coverage based upon their unique health care needs and financial circumstances.

In addition, Medicare advisors stay updated on the most up to date adjustments in plans and guidelines, providing customers with one of the most current details. This assistance not just minimizes confusion yet likewise empowers individuals to make informed choices, eventually leading to better complete satisfaction with their Medicare strategy options.

Customized Strategy Referrals

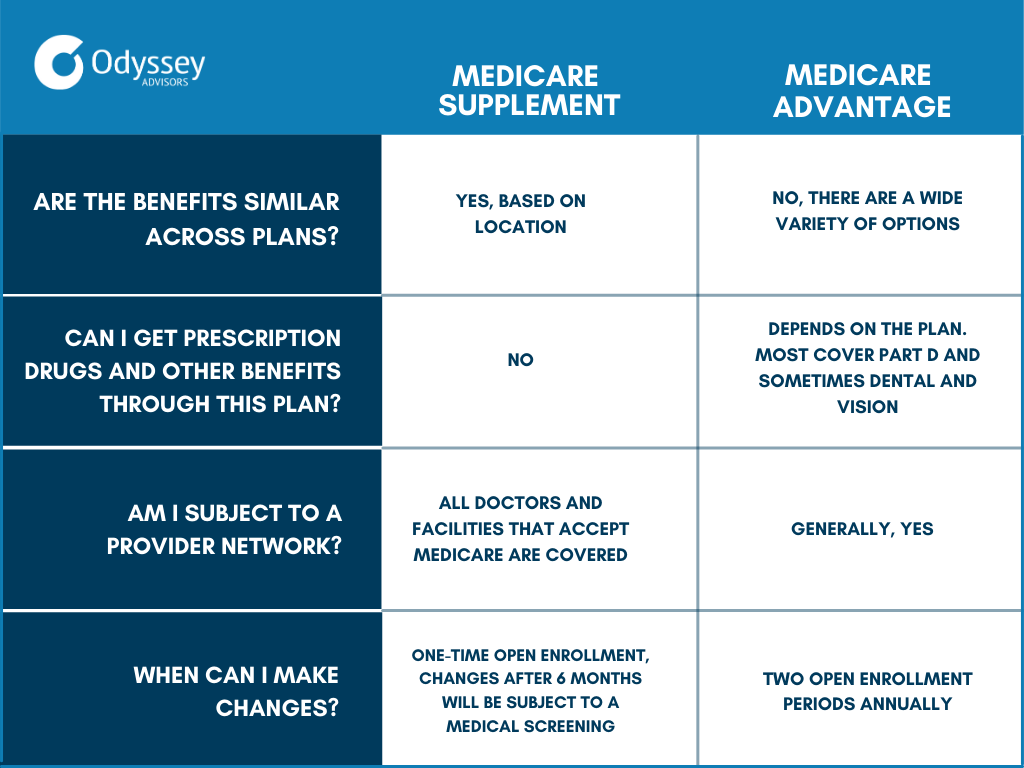

Medicare advisors play a pivotal function in crafting personalized plan recommendations customized to each person's unique health care demands. By thoroughly examining a customer's medical background, budget, and choices, these advisors can determine one of the most appropriate Medicare strategies available. They assess different aspects, including insurance coverage options, costs, and company networks, assuring clients get optimal worth from their selected strategies.Medicare advisors stay upgraded on the latest plan adjustments and protection alternatives, allowing them to give enlightened suggestions that align with existing guidelines. They also take into consideration way of living factors and details wellness conditions that may affect a client's health care decisions. This customized approach not just enhances the client's understanding of their choices yet likewise builds confidence in choosing a strategy that best satisfies their needs. Inevitably, the knowledge of Medicare advisors warranties that individuals browse the complicated landscape of Medicare with tailored remedies for perfect healthcare management.

Browsing Enrollment Deadlines

Just how can individuals guarantee they don't miss vital enrollment deadlines for Medicare? One effective approach is to deal with a Medicare advisor that focuses on the registration process. These professionals provide vital support on the different registration periods, consisting of the First Registration Duration, General Registration Duration, and Unique Enrollment Periods, guaranteeing people recognize when to act.Furthermore, advisors can aid establish pointers for crucial dates, allowing people to maintain concentrate on their health care requirements as opposed to entirely on deadlines. They can likewise clarify the ramifications of missing these deadlines, which may cause delayed protection or greater premiums. By partnering with a Medicare advisor, individuals can browse the in some cases complicated landscape of enrollment due dates with self-confidence, lowering the threat of expensive blunders. Inevitably, this proactive method causes more informed choices and far better health and wellness treatment end results.

Recognizing Costs and benefits

Maneuvering with Medicare's registration target dates is simply the start of the process; comprehending the prices and benefits connected with the program is just as crucial. Medicare supplies numerous plans, including Initial Medicare, Medicare Benefit, and Medicare Component D, each with distinct benefits and potential out-of-pocket prices. Recipients must assess insurance coverage options, such as hospitalization, outpatient services, and prescription drugs, to guarantee their details health needs are met.Furthermore, recognizing premiums, deductibles, copayments, and coinsurance can significantly affect a recipient's economic preparation. A Medicare advisor can break down these elements, helping individuals make informed selections that straighten with their medical care demands and budget plans. Medicare advisor near me. By clarifying these elements, recipients can stay clear of unexpected costs and ensure they get the essential care. Eventually, understanding the prices and benefits related to Medicare is necessary for taking full advantage of protection and decreasing financial strain

Continuous Support and Support

While maneuvering via the intricacies of Medicare can be frightening, ongoing support and assistance from a Medicare advisor can considerably reduce this burden. These professionals provide constant support, assisting individuals navigate the ins and outs of their selected strategies. They are offered to respond to concerns, clear up coverage details, and deal with any kind of concerns that may occur throughout the strategy year.Medicare advisors keep clients educated concerning modifications in options and laws, making certain that people are always aware of their civil liberties and advantages. They can help with plan changes during open registration durations, customizing insurance coverage to far better satisfy advancing medical care demands. This assistance promotes self-confidence and comfort, permitting recipients to concentrate on their wellness instead of the details of their Medicare strategies. Ultimately, recurring advice from an advisor acts as a useful resource, boosting the general experience of taking care of Medicare coverage and making sure beneficiaries make educated decisions.

Optimizing Financial Savings on Medical Care Costs

Efficient ongoing assistance from a Medicare advisor can likewise lead to substantial financial savings on health care expenditures. By examining an individual's specific health care needs and financial scenario, a Medicare advisor can suggest strategies that use the most effective value. Medicare supplement agent near me. They aid customers in recognizing the subtleties of costs, deductibles, and copayments, guaranteeing that beneficiaries select plans that minimize out-of-pocket pricesIn addition, advisors can aid recognize possible voids in insurance coverage, such as prescription medicines or specialized treatment, enabling far better economic preparation. They remain upgraded on modifications in Medicare plans, making it possible for clients to take benefit of brand-new programs or advantages that could decrease expenditures.

Inevitably, collaborating with a Medicare advisor empowers individuals to make educated choices that align with their healthcare needs and budget plan, taking full advantage of savings while guaranteeing access to required care. Medicare agent. This calculated method can result in considerable economic alleviation in an often complicated healthcare landscape

Frequently Asked Inquiries

Exactly how Do I Find a Certified Medicare Advisor?

To find a certified Medicare advisor, people must look for suggestions from relied on resources, inspect on the internet evaluations, and verify qualifications through specialist companies, making certain the advisor is well-informed concerning Medicare guidelines and plans.What Are the Prices Related To Working With a Medicare Advisor?

Hiring a Medicare advisor commonly entails either a level fee, a portion of the costs, or commission-based payment from insurance policy carriers. Costs can differ significantly depending upon the advisor's experience and services offered.Can a Medicare Advisor Aid With Long-Term Treatment Preparation?

A Medicare advisor can aid with long-lasting care preparation by giving support on offered protection options, helping customers understand benefits, and ensuring they make educated decisions to safeguard ideal care for future health needs.Are Medicare Advisors Compensated by Insurance Business?

Medicare advisors can receive settlement from insurance provider via compensations or fees for the policies they sell. This arrangement incentivizes advisors to give advice, although it may influence their recommendations regarding strategy choice.Exactly how Frequently Should I Meet My Medicare Advisor?

Individuals must preferably meet their Medicare advisor yearly, or whenever considerable life modifications happen. Normal consultations guarantee that their healthcare requires straighten with anchor readily available strategies, making best use of benefits and avoiding possible voids in protection.

Medicare advisors play a pivotal function in crafting tailored plan suggestions customized to each person's one-of-a-kind healthcare requirements. By completely examining a customer's clinical history, budget, and preferences, these advisors can determine the most appropriate Medicare strategies readily available. Medicare offers different strategies, including Original Medicare, Medicare Advantage, and Medicare Component D, each with distinctive benefits and potential out-of-pocket expenses. Medicare advisor. While maneuvering through the intricacies of Medicare can be frightening, recurring assistance and support from a Medicare advisor can significantly relieve this worry. By assessing a person's particular healthcare demands and monetary scenario, a Medicare advisor can advise plans that offer the best value

Report this wiki page